BTC Price Prediction: $130K Target in Sight as Institutional Demand Meets Technical Breakout

#BTC

- Technical Breakout: Price holding above 20MA with Bollinger Band squeeze suggests volatility expansion

- Institutional Catalysts: GameStop's Bitcoin strategy and ETF inflows provide fundamental support

- Political Momentum: Trump's crypto legislation push reduces regulatory uncertainty

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

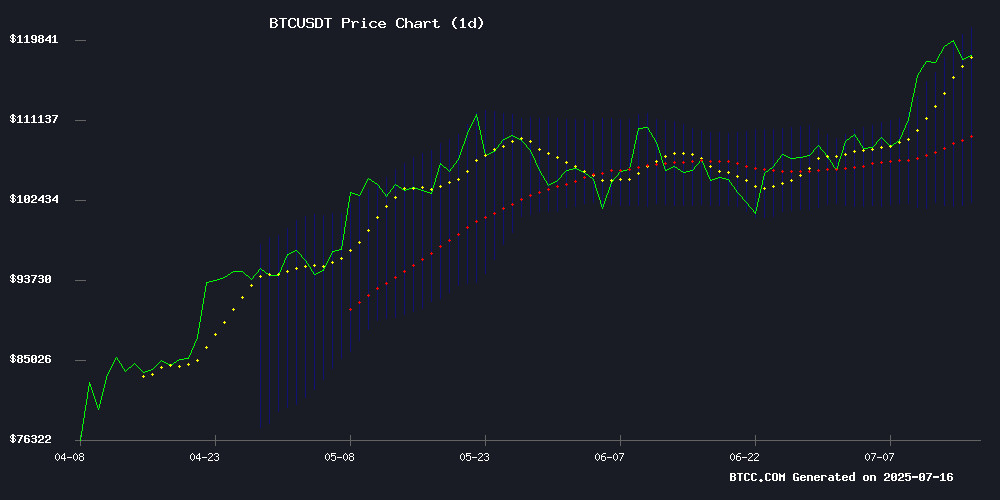

BTC is currently trading at, comfortably above its 20-day moving average (111,693.10), indicating a bullish near-term trend. The MACD histogram remains negative (-1,431.23), but the narrowing gap between signal lines suggests weakening downward momentum. Prices are testing the upper Bollinger Band (121,307.23), which could act as immediate resistance. According to BTCC analyst James, 'The reclaiming of the 20MA with volume could open a path toward 130,000 if institutional inflows continue.'

Market Sentiment: Institutional Adoption and Political Support Fuel BTC Rally

Positive catalysts dominate headlines: GameStop's $500M Bitcoin treasury move and payment integration plans coincide with Trump's pro-crypto legislative push. ETF inflows and reactivation of dormant whale wallets (including a 4.68B BTC transfer) suggest strong institutional interest. James notes, 'The Altcoin Season Index at 30 shows capital is starting to rotate, but Bitcoin's dominance remains intact - this isn't speculative frenzy but smart money positioning.'

Factors Influencing BTC’s Price

GameStop Explores Crypto Payments Amid $500M Bitcoin Investment

GameStop CEO Ryan Cohen signals potential cryptocurrency integration for trading card purchases, marking a strategic shift away from hardware dependence. The retailer's renewed crypto focus follows a $500 million Bitcoin acquisition, positioning digital assets as both transactional tools and inflation hedges.

"We're evaluating all cryptocurrencies," Cohen told CNBC, emphasizing utility beyond speculation. The move revives GameStop's crypto ambitions after previous regulatory setbacks, with Bitcoin's inflation-resistant properties driving institutional interest.

BTC Surges Past $120K: Strength or Overextension?

Bitcoin's rally beyond $120,000 has reignited market optimism, though questions linger about its sustainability amid macroeconomic uncertainties. The breakout isn't just a nominal high—it's a technically robust MOVE that confirms the dominant bullish trend on higher timeframes.

The cryptocurrency decisively cleared its previous all-time high of $112,000, closing the week at unprecedented levels. Even a 10% correction WOULD leave the overarching uptrend intact, with liquidity dynamics continuing to support BTC's long-term price trajectory.

PrimeXBT and other platforms are seeing increased activity as traders position for potential dips in this volatile yet clearly bullish environment. The move's momentum suggests institutional participation, though retail FOMO could accelerate volatility in coming sessions.

Altcoin Season Index Spikes Above 30 Amid Lingering Bitcoin Dominance

The crypto market teeters on the edge of an altcoin resurgence as the Altcoin Season Index breaches the 30-point threshold. Bitcoin's dominance remains stubbornly high at 66%, but cracks are appearing in its hegemony as top-tier altcoins show signs of life.

July's market dynamics reveal a subtle power shift. Where only 12 altcoins outperformed BTC in June, the current index surge suggests growing momentum among the Top 100 projects. This comes after months of brutal underperformance that saw the index crater to 12 - a nadir that now appears to have marked the turning point.

Market watchers are tracking the 75-point threshold on the Altcoin Season Index as the definitive signal for full-blown alt season. The current rally, while preliminary, has injected Optimism into altcoin portfolios that have languished during Bitcoin's extended reign.

Trump Intervenes to Rescue Crypto Legislation Amid GOP Rebellion

US President Donald Trump brokered a late-night deal with conservative House Republicans to salvage pivotal cryptocurrency legislation, reversing a surprise procedural defeat that had rattled markets. The intervention came after 13 GOP hardliners joined Democrats to block debate on the bills earlier in the day, triggering a swift Bitcoin selloff from $120,000 to $116,000.

The breakthrough followed an Oval Office meeting between TRUMP and dissenting lawmakers, after which the president announced on Truth Social that all parties had agreed to advance the rule vote. House Speaker Mike Johnson reportedly supported fast-tracking the legislation, which now includes three major industry-backed bills poised to reshape US digital asset regulation.

Market reaction was immediate, with crypto-linked stocks and bitcoin prices whipsawing on the political drama. The episode underscores growing institutional recognition of cryptocurrency's electoral and economic significance ahead of the November elections.

GameStop Explores Bitcoin Payments for Trading Cards as Inflation Hedge

GameStop CEO Ryan Cohen revealed the company is considering bitcoin payments for trading card purchases, marking a strategic shift toward collectibles amid declining hardware sales. The move aligns with GameStop's recent $500 million bitcoin acquisition, which Cohen explicitly framed as a hedge against inflation and global monetary expansion.

The retail giant previously retreated from NFT and crypto wallet ventures due to regulatory uncertainty. Yet its bitcoin treasury allocation signals enduring institutional conviction in crypto's store-of-value proposition. "The utility of crypto beyond investing is a hedge against inflation," Cohen told CNBC, acknowledging bitcoin's primary demand driver in current markets.

Bitcoin Rebounds as Trump Backs Crypto Legislation, ETFs See Strong Inflows

Bitcoin price recovered to $119,000 Wednesday following a 1.74% decline, buoyed by political developments and sustained institutional demand. The rebound coincides with former President Donald Trump's announcement that the GENIUS Act is poised for House approval during 'Crypto Week' - a move interpreted as bullish for regulatory clarity.

US-listed spot Bitcoin ETFs recorded over $400 million in inflows Tuesday, marking the seventh consecutive day of positive flows since July 2. This institutional participation underscores growing mainstream adoption despite recent price volatility.

Trump's Truth Social post revealed bipartisan support, with 11 of 12 required lawmakers reportedly agreeing to advance the legislation. 'After a short discussion, they have all agreed to vote tomorrow morning in favor,' Trump stated from the Oval Office, suggesting accelerated progress for crypto-friendly policies.

Bitcoin Rally May Continue as 'Peak Signal' Remains Absent: CryptoQuant Analysis

Bitcoin's rally shows no signs of peaking, according to CryptoQuant analyst Axel Adler Jr. The absence of a 'Peak Signal'—a metric that typically appears at market tops—suggests further upside potential. Bitcoin recently surged past $122,000 before settling at $118,231, buoyed by institutional demand and favorable policy.

Alexander Zahnd, interim CEO of Zilliqa, notes this rally differs from past cycles. "It's spot-driven, not built on leverage, and unfolding in a calm market," he said. Such conditions point to a more mature market structure, with some analysts eyeing $130,000 if momentum holds.

bepMINER Revolutionizes Bitcoin Mining with AI-Driven Efficiency in 2025

As the cryptocurrency mining industry grapples with the aftermath of Bitcoin's fourth halving, bepMINER emerges as a game-changer. The platform's AI-driven architecture delivers a 30% energy efficiency improvement, addressing critical pain points in an era of rising computational demands and environmental scrutiny.

Post-halving dynamics have reshaped the competitive landscape, with block rewards now at 3.125 BTC. Traditional mining operations face existential threats from escalating electricity costs and regulatory pressures, while network hash rate fluctuations create additional volatility. bepMINER's transparent profit guarantee mechanism positions it as a leader in the new wave of sustainable mining solutions.

The platform's cloud mining contracts offer unprecedented flexibility, particularly valuable during periods of network adjustment. With global hash rate recovering from an initial 20% drop post-halving, intelligent mining solutions like bepMINER's are redefining industry standards for profitability and operational resilience.

GameStop Forges Its Own Bitcoin Strategy as Institutional Adoption Grows

GameStop CEO Ryan Cohen has clarified that the company's $512.6 million Bitcoin acquisition—4,710 BTC at an average price of $108,837—serves as an inflation hedge rather than a replication of MicroStrategy's yield-focused approach. The position has already gained 15% as Bitcoin hit $123K in July.

With $9 billion in cash reserves, Cohen emphasized disciplined capital deployment toward high-upside, low-risk opportunities. The strategy appears complementary to Q1 2025 results showing a $44.8 million net income rebound despite an 18% sales decline.

The move signals deepening institutional conviction in Bitcoin's store-of-value proposition. Emerging projects like Bitcoin Hyper ($HYPER) aim to capitalize on this trend by expanding Bitcoin's utility as 'digital gold' gains mainstream traction.

Bitcoin Faces Liquidity Test as Satoshi-Era Whale Moves $4.68 Billion in BTC

Bitcoin's market depth faced a critical stress test in July as a long-dormant whale from the Satoshi era transferred 40,009 BTC ($4.68 billion) to Galaxy Digital. The institutional firm subsequently deposited 6,000 BTC ($706 million) across Binance and Bybit, signaling potential sell-side pressure.

Despite the magnitude of these movements—comparable to Germany's 2023 Bitcoin sales—the market absorbed the liquidity shock with remarkable resilience. Blockchain analysts note Galaxy Digital employs gradual sell-offs in 200-300 BTC increments, demonstrating sophisticated market positioning.

"Bitcoin now ranks among Earth's most liquid assets," observed market analyst Vijay Boyapati. The cryptocurrency's ability to weather billion-dollar transfers without significant price disruption marks a maturation milestone, contrasting sharply with its historical volatility during large movements.

Bitcoin Whales Signal Potential Market Pivot as Dormant Supply Reactivates

Bitcoin's rally paused with a 4% pullback from all-time highs, a typical retracement during bull markets. On-chain metrics now suggest a potential mid-cycle pivot as whale activity surges and dormant coins re-enter circulation.

CryptoQuant data reveals Coin Days Destroyed spiked to 28 million this week, indicating movement of long-held BTC. This pattern historically precedes strategic repositioning by large holders NEAR cycle inflection points. Simultaneously, Net Realized Profit/Loss metrics show $4 billion in realized gains - the highest since Q2 - confirming aggressive profit-taking near the $117,000-$120,000 range.

The current whale behavior contrasts sharply with late June's market dynamics. Where recent buyers previously capitulated, long-term holders now appear to be strategically deploying capital. This shift coincides with institutional rebalancing periods, suggesting calculated moves rather than speculative trading.

How High Will BTC Price Go?

Based on current technicals and market structure, BTCC's James outlines three potential scenarios:

| Scenario | Target | Key Levels |

|---|---|---|

| Bullish | 130,000-135,000 | Break above 121,307 (Upper BB) |

| Base Case | 125,000 | Hold 20MA at 111,693 |

| Bearish | 102,000 | Lower BB support |

'The MACD's impending bullish crossover and political tailwinds make the 130K target achievable within Q3,' James concludes.